Energy Finance

in Japan

Financing Climate Change and Nuclear Risk

Energy Finance in Japan is the first quantitative and representative analysis of private Japanese financial Institution’s support for fossil fuel and nuclear power companies.

Financial databases were used to calculate all known corporate loans, underwritings, bondholdings, and shareholdings from 197 Japanese financial institutions provided to 23 selected Japanese companies engaged in the fossil fuel and nuclear power generation sector over the period January 2011 to April 2016.

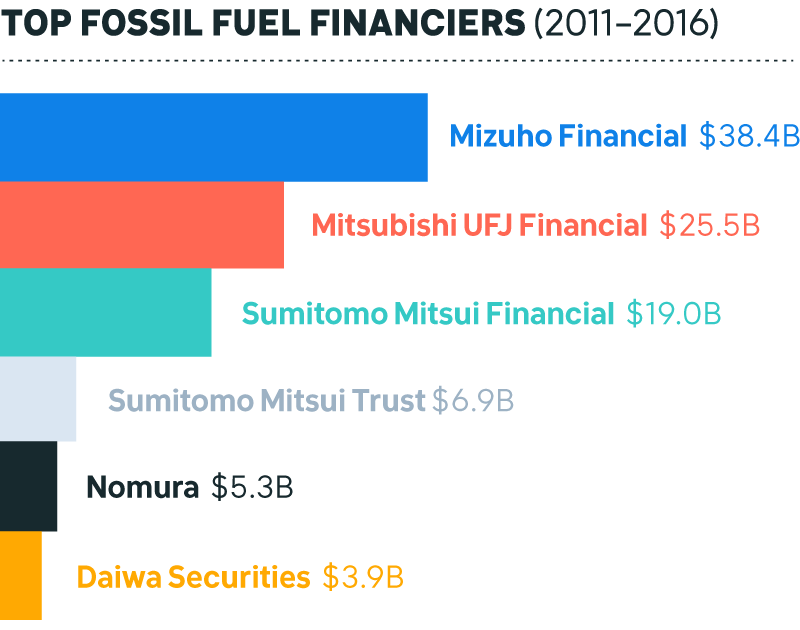

Fossil Fuels

61 financial institutions provided loans and underwritings to fossil fuel companies amounting to approximately $109.9 billion USD between 2011 and 2016. 95% of these were provided by the top 10 financiers.

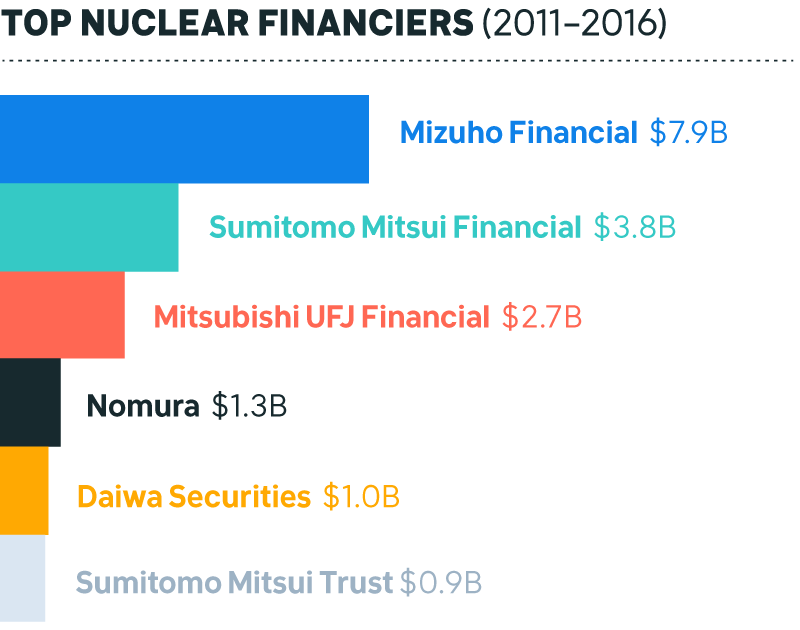

Nuclear

54 financial institutions provided loans and underwritings to nuclear power companies amounting to approximately $20 billion USD between 2011 and 2016. 94% of these were provided by the top 10 financiers.

Of the 197 financial institutions researched, 47 did not provide any financing to the fossil fuel or nuclear power companies selected for the report.

“Continued support for fossil fuels and nuclear power by Japan’s financial sector may be hindering the transition to a renewable future.”

Share this on Twitter

Japanese financiers provided $110 bn in loans to fossil fuel companies between 2011-2016. 350.org/ja/my-bank-my-future

Japanese financiers provided $20 bn to nuclear power companies between 2011-2016. 350.org/ja/my-bank-my-future

47 companies in Japan not financing fossil fuels or nuclear power. New Report >> 350.org/ja/my-bank-my-future

350.org JAPANの最新情報を受取る

100%自然エネルギー社会の実現ためには皆さんの参加が必要です。メルマガでは、最新ニュース・イベント・勉強会・アクション情報をいち早くお届け。ぜひご参加ください。