By Rowland Davis

March 2, 2020

Jim Cramer is not the world’s smartest man (in March of 2008 he told his viewers to hold onto their shares of Bear Stearns), but the CNBC pundit is a window into the latest Wall Street conventional wisdom. So it is not insignificant when he says, “I’m done with fossil fuels…they’re just done. We’re starting to see divestment all over the world.” Indeed, when Bill McKibben and Naomi Klein both tweet their approval, maybe we should look closer at what is happening.

The divestment movement led by 350.org can be viewed as the tip of the spear which raised awareness of fossil fuel investment issues. Although moral issues have been primary in these discussions, the financial case has also grown in importance. In the last several months, we have seen the investment community tuning into these financial issues, and significant action appears (hopefully) to be on the horizon. To be clear, this does not mean that most institutional investors will be jumping straight to a full-on divestment commitment. But the investment and financial community now appears to be taking the potential risks involved with FF investments very seriously, leading many investors to explore ways to “decarbonize” their portfolios.

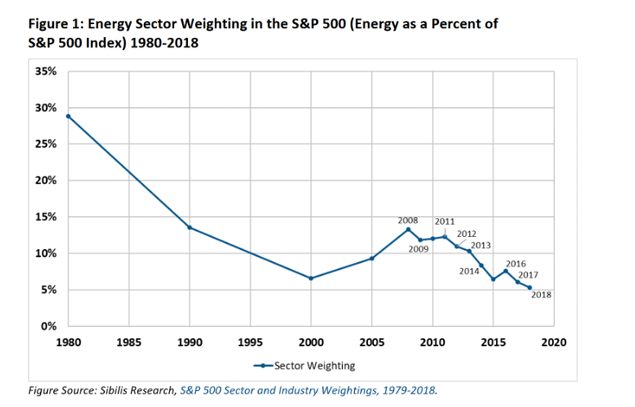

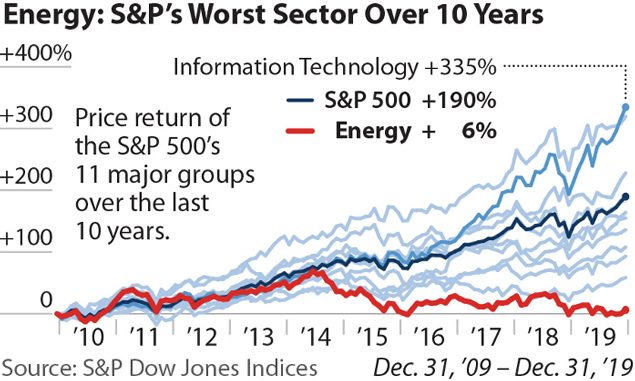

Bill McKibben has been clear that the major goal of the divestment movement was to strip away the “social license” for the FF industry to continue their business-as-usual plans. This social license is clearly more at risk when FF stocks are considered to be losers. The energy sector of the stock market (mostly Big Oil) has been the worst performing sector over the last decade, with 2019 being a particularly bad year.

This makes it easier for major investors to consider divestment or decarbonization strategies, or at least to begin analyzing the future investment risks as FF stocks are devalued, driven by sharp declines in future demand and possible stranded assets when drilling projects turn unprofitable. Analysis of these investment risks has advanced significantly, based on work done by the Carbon Tracker Initiative and the 2⁰Investing Initiative, among others. For example, a recent report from Carbon Tracker shows the extent to which each individual oil company may see their value decline, based on detailed study of all of the oilfield projects around the globe. In aggregate, values for oil companies might decline by about 20% — but most of the large US oil companies are exposed to larger declines (Exxon -28%, Chevron -26%, Oxy -34%). Sophisticated institutional investors require this kind of hard analysis to support any decarbonization efforts.

So there is reason to believe that these economic pressures will be pushing in the same direction as climate activists are pushing. Here are just some of the recent headlines that give us hope:

- The University of California announces FF divestment for both endowment and pension funds, based solely on financial risk concerns.

- The number one topic at this year’s Davos Conference was the climate crisis and how business needs to become part of the solution.

- Larry Fink, CEO of Blackrock (the largest investment firm in the world), announces that “climate risk is investment risk” and that his firm will be scrutinizing their investments with sustainability metrics.

- Central banks around the world are starting to recognize climate risks to the global financial system. The Bank of England will now require climate-based stress tests for banks.

- Disclosure requirements for pension funds are starting to include climate-related risks and action steps, with the strongest mandatory changes being proposed in the U.K.

- The Dutch pension fund ABP, the largest in Europe, announces a plan to move their investments toward a climate-neutral position.

- Activity in the Sustainable Investing world is at an all-time high. ESG funds had the biggest dollar inflows in 2019, rising by 300% over the prior year. And the toolbox of ESG metrics are becoming more sophisticated for use by pension funds and other institutional investors to develop a path toward decarbonized portfolios, converging on a more standardized understanding of what it means for a fund to be aligned with the “net-zero by 2050” target.

Climate activists are often skeptical of corporate claims of climate progress – and rightly so, as these have frequently been attempts at greenwashing. However, the scope and scale of these trends in the investment world have the feel of real change.