Employer retirement plans usually offer employees a choice of how to invest money based on the criteria of age (how close to retirement) as well as on the tolerance for financial risk. In the case of my former employer, Alcatel-Lucent, and 401k account managed by Fidelity, these lifecycle choices were labeled with the retirement age, like “Retirement Date 2020”, “Retirement Date 2025”, etc. Each choice was a large set of stocks and other financial instruments and was actively managed by Fidelity to achieve stated financial goals. Nowhere was the employee permitted to adjust the mix of what comprised such “Retirement Date 2020”, etc., portfolio. Short-term, bond or equity asset classes were also offered, but with the same restrictions: one did not know where the monies were invested nor had any detailed choice in the matter. With other employers, there could be more choices, including socially responsible (SR) investing (like with TIAA-CREF, “Social Choice”) or direct investing into a given segment of economy (e.g., “Biotechnology”) or region (like “Emerging Markets”), but so far there is not a 401k/403b plan that would allow screening against fossil-fuel investments.

First question: How to gain some control over where is the 401k/403b money invested, apart from the typical lifecycle or other choices that employers provide?

- Upon leaving an employer, one has an option to convert the 401k/403b account to an IRA. With an IRA, one has the flexibility to direct money to specific mutual funds (MF) or other financial instruments.

- Even if one stays with the same employer, an option to apply for and open a Self-Directed Brokerage Account (“Brokerage Link”), into which a portion or all of 401k savings can be transferred, may be available. That was the case with my former employer. This option was neither advertised nor visible on the Fidelity website for Alcatel-Lucent, but upon request, it was made available to me. I learned about this from a co-worker, and would advise that some persistence in asking for this option may be required.

Once I was approved for Brokerage Link, I transferred my 401k savings into its money market/cash reserve. There was a one-time fixed fee of $75 for this transfer (not dependent on the amount of money transferred). However, if one directed all future deposits to go there, this fee would kick in with every deposit. Therefore I decided to first accumulate a bunch of monthly deposits in the original account, and only transfer the money to the Brokerage Link once a year or so. I setup this account to reinvest all eligible mutual fund distributions in the fund that paid the distribution to avoid having to deal with capital gains. There were no additional administrative fees for keeping the money in the Brokerage Link account. However, this may not be the case with a different employer plan and needs to be looked into.

Another note: my Alcatel-Lucent 401k account has transitioned from Fidelity to Aon Hewitt and then to Principal, and every one of these retirement management/financial services companies has recognized and continued to support the Self-Directed Brokerage Account I started in 2007.

Second question: Once you have a possibility to choose, how do you find fossil-fuel free investment options?

Once having access to the Brokerage account, I was able to directly influence where my money was going. In 2007, I made the selection and purchased shares of several funds that provided socially responsible screens before investing in companies, and I tried to diversify the portfolio to include mixed asset classes, like small cap, mid cap, equity income, investment bonds and both US and international fund options. (I am not particularly versed in investing, but had a general notion of need for diversification). I also invested a portion of the money into alternative energy fund.

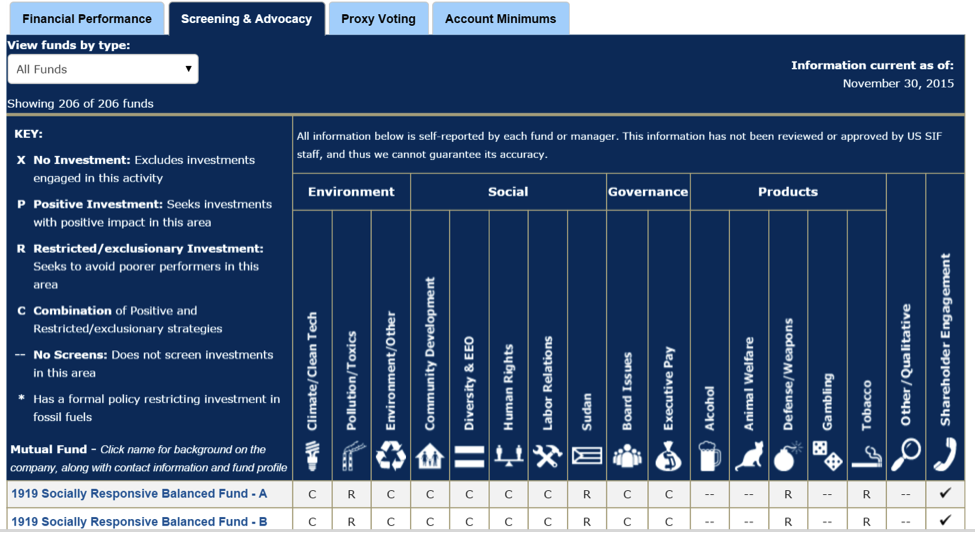

A lot of information about such funds can be obtained from http://charts.ussif.org/mfpc/. Apart from learning about the fund’s past performance, inception date, volume of managed money, etc., one can, under the tab “Screening and Advocacy”, see all the possible different criteria used by the fund managers to select companies into which the money is invested.

Please note * symbol denoting that the fund has a formal policy restricting investment in fossil fuels.

As of Nov 2015, http://charts.ussif.org/mfpc/ provides a list (and detailed information) on 206 socially responsible mutual funds, and one can find several denoted with the * symbol. Hovering over the table’s row and columns brings up more information about given fund’s strategy in each area. Each row is a clickable link to information from fund’s prospectus, its costs, fees and performance data.

One can also further investigate these funds using Fidelity (or the financial company managing the 401k/403b), with search /research options and using the mutual fund’s symbol.

I had paid close attention to the rating given to these funds by Morningstar rating agency (this info was available via Fidelity) and to the past performance of the funds. There is always a caveat that past performance does not guarantee good future outcomes, but one has to make one’s decisions somehow… A major criteria for me was also complete restriction of weapons/defense from the investment.

Third question: What kind of fees apply when making purchases within Brokerage Link?

Transaction/commission fees: in most cases, the transaction fee was zero, unless I would have sold these mutual funds within 180 days. For mutual funds (MF) outside of the Fidelity Network, one would incur the transaction fee (of $75, per transaction, in my case).

Load fees: there were 3 possibilities: a MF had no load (no fee), front load, or back load. A front load fee is paid when you purchase the shares, a back load when you sell them. I did buy some MF that had front load fees (of 4.75%), because I wanted that specific MF… Also note that MF without load fees may have higher management fees, so that these type of funds may have a lower long-term rate of return.

Management fees: these are paid to the MF company for managing the fund. They can be as low as ~0.25% per annum for index funds and ~1.3% or less for non-index funds.

As I have learned from my experiences, it is important to pay close attention to the fees, understand that the market may perform poorly over a long period of time (some international markets have not recovered since depression of 2008), and the time for “making money” off of alternative energy investing might not have come yet. Some funds performed quite well though, e.g., Parnassus Core Equity Investor (PRBLX), a fund that gets 3 green badges* from www.fossilfreefunds.org and is 4-star rated by Morningstar. Regardless of these ups and downs, it is a great feeling to know that most of my savings are not invested in the production of guns and weapons nor climate-change causing fossil fuels. My rate of return turned out to be 6.3% annually, which is very respectable, hence with SR and fossil fuel free (or mostly free**) investing one does not need to sacrifice on the financial performance.

*there are different categories of fossil fuel screens and one can consider what criteria are or are not sufficient to reject the fund. See more at www.fossilfreefunds.org, free tool provided by As You Sow.

**PRBLX fund passes default “Carbon Underground 200” screen of www.fossilfreefunds.org (0% holding in companies that have carbon-based resources underground), does not have any “Filthy 15” stock nor any coal industry holdings, but has 2.84% of oil/gas industry and 3.41% of fossil-fired utilities.

In 2013 I opted to invest portion of the retirement in funds that are completely fossil fuel free on all counts, and selected GCBLX Green Century Fund and PORTX Portfolio 21 Global Equity Fund. More funds and options for choosing exist now than before. I am also considering putting some money directly into renewable energy. An article on this http://www.renewableenergyworld.com/articles/2015/01/uncovering-green-alternative-energy-mutual-funds.html offers more info.

It appears that in addition to mutual funds, other financial instruments, like ETF (Exchange Traded Funds) are also being created with fossil fuel free screens. Examples are NYSEARCA:ETHO and SPYX.

Any advice and/or information contained in this article are part of a personal story and are not to be considered specific investment advice. Individuals should research on their own and/or seek advice from their investment professional before making any important financial decisions.