The Fiscal Case for Fossil Fuel Divestment

By Larry Coble and Joe Antoun, CFP

Executive Summary

Human civilization is swiftly proceeding toward the culmination point of a long-developing and holistic revolution in the energy sector for power generation, transportation and storage technology. With renewable energy sources, such as Solar PV and Wind generation gaining market share and experiencing dramatic price drops and projected to become the cheapest form of power generation by 20202, the installation and operation of alternative energy technologies will continue displacing 20th century carbon emitting energy generation facilities and transportation systems utilizing oil, coal and natural gas. According to a Morgan Stanley report of July 6th, 2017,

“Numerous key markets recently reached an inflection point where renewables have become the cheapest form of new power generation,” the bank said in a note.

“A dynamic we see spreading to nearly every country we cover by 2020. The price of solar panels has fallen 50% in less than two years (2016-17).”

Renewable energy sources, like solar and wind, are quickly becoming as cheap—even cheaper—than their carbon-intensive counterparts like coal.3

Rapid buildout and utilization of renewable technologies will create seismic shifts and disruptions in markets for energy and transportation, leaving incumbent technologies and fossil fuel assets experiencing diminished utilization, followed by becoming stranded and written off on balance sheets as losses. With the author’s having researched the topic from a multiplicity of sources from the business press, think tanks, investment houses, government agencies and academia, this paper reports the latest findings on the financial and technological viability of the following renewable energy technologies:

- Solar PV

- On-Shore Wind Generation

- Battery Storage

- Electric Vehicles (EV’s), including Automated versions

While the paper explores the current and future status of the above technologies, the document studies the future of fossil fuels and related infrastructure and the financial stakes of maintaining investments in oil, coal and gas.

While the transition from a fossil fuels to renewables is occurring, the shifts will not necessarily follow a slow trend path. The evolution of the marketplace may occur rapidly with sudden leaps, causing swift adaptation of newer technologies and displacement of older, fossil fuel based equipment and economics, much like smart phones rapidly displaced flip phones and land lines.4 Over the next 3 – 10 years, the energy technology revolution will begin displacing, sometimes swiftly, coal, oil and lastly gas as the prominent fuels for economic activity, allowing for renewables and storage technology to increasingly dominate the economic investment landscape for energy generation and transportation.

Key Findings:

- Coal has lost 90% of its Market Capitalization and will not recover due to economic forces favoring renewable technologies. Increased world-wide regulations will further exacerbate the decline in coal utilization but will not prove the decisive factor in the future.5 Costliness of coal versus wind and solar will drive the fossil fuel from the marketplace as well as the infrastructural age of most coal burning power plants.6

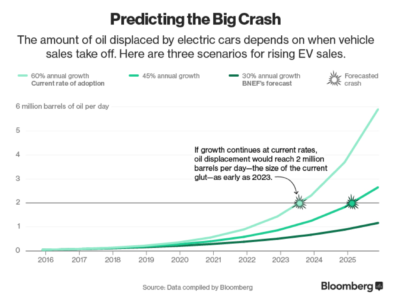

- Oil will hit peak demand between 2020 and 2023 with an estimated 2 million barrels per day(mbd) being removed from the market and the potential of 25 – 30 mbd by 2030, causing a slump in prices and driving costly oil fields from production, thus leading to diminishment in oil company valuations, especially corporations heavily invested in expensive Tar Sands and Shale extraction.7/ 8

- Electric Vehicles (EV’s) and Autonomous Electric Vehicles (A EV’s) are poised to increase market share globally due to improvements in battery technology, scalability, lower manufacturing costs, advantages of longevity and the Transportation as a Service (TaAS) model of ride sharing already prevalent in major cities through companies such as Uber and Lyft. Worldwide regulations to meet COP21 climate goals will accelerate the changeover process from Internal Combustion Engines (ICE) to EV’s.9

- Natural Gas will experience competition from cheaper renewable technologies such as Solar PV and On-Shore wind for power generation. Both renewable technologies will prove less costly to install, maintain and operate than conventional natural gas by 2020. According to Business Insider and Morgan Stanley, Solar and Wind “will be the cheapest source of power in the world in less than three years.”10

- Battery Storage technology: “Demand for energy storage from the utility sector will grow more than the market anticipates by 2019-20,” the report from Morgan Stanley asserts. The demand for storage is expected to grow from a less than $300 million a year market to as much as $4 billion in the next two to three years. Battery Storage Technology will create conditions for “wind and solar to become a dependable rather than an unpredictable source of energy.”11

The following paper collates the findings of the business press, analyses from major investment houses, think tanks, government agencies and academic studies into a document depicting the rapid shifts and disruptions occurring in the energy and transportation sectors across the United States and the globe. The document attempts to gather and illustrate the growing consensus of financial, energy and transportation analysts regarding the forthcoming and ineluctable changeover from a fossil-fuel based economy to a system powered by renewable resources and the technology designed to capture, distribute, store and operate in the forthcoming new energy economy. While this document depicts a snapshot of market conditions in late 2017, the rapid shift toward energy sectors dominated by renewable energy technologies will only accelerate across the globe, leaving incumbent fuel sources and equipment with ever diminishing roles, moving to unviability and eventual elimination from the economy.

Thoroughly footnoted and utilizing reporting and analyses from esteemed outlets and organizations, the document outlines the multiplicity of reasons investors, especially cities, their operating budgets and their attendant pension funds should heed the gathering trend lines and begin the process of divesting from the fossil fuel energy sector. With renewables poised to gain increasing market shares, the oil, coal and gas sectors will undergo reduced demand trending toward zero due to economic and regulatory pressures from markets and government respectively, leaving assets in the ground and facilities designed to explore, mine, process and burn fossil fuels increasingly diminished in value and heading towards non-utilization, stranding and worthlessness.

The Forthcoming 21st Century Renewable Energy Systems Revolution

Climate change poses the greatest challenge for humanity in the 21st century. In fact, 17 of the warmest measured years have occurred over the past 18 and 2016 was the hottest yet.1 Global warming and resultant climate change will continue unabated unless steps are taken to quickly diminish and end carbon emissions from the burning of coal, oil and gas for energy production and transportation.

In the UN COP21 agreement from 2015, the 194 signatories approved a framework to keep carbon dioxide emissions below a threshold to prevent dangerous temperature rise and trigger cataclysmic weather events. At the existing rate of carbon consumption, the planet will reach 450 ppm by 20362 and cause the overall temperature of the planet to rise 2 C or 3.6F, triggering destructive effects to our environment and creating planetary conditions hostile to life in its present form.3 As of October 4th, NOAA reports the planet’s temperature has risen to 1.25 C above pre-Industrial Revolution levels.4 Many scientists such as the former NASA climate scientist James Hansen believe global temperatures should be kept below 1.5 C.5 With approximately 8 -10 years remaining before the 1.5C threshold is breached, societies must act quickly to limit further damage.6

With the arrival of renewable energy technologies, the opportunity to mitigate and prevent further CO2 emissions, warming and catastrophic climate change has proved cost effective and increasingly competitive in the market place.7 Alternative technologies such as on-shore wind, solar PV, LED’s, hybrid and electric vehicles and battery storage technology are gaining in market share and their manufacturing costs have fallen and will continue to fall, making renewable solutions more attractive for widespread utilization.8 As of 2016, solar and wind are now competitive or lower in cost to install and operate than natural gas for energy production. According to Bloomberg News, “The reason solar-power generation will increasingly dominate: It’s a technology, not a fuel. As such, efficiency increases and prices fall as time goes on. What’s more, the price of batteries to store solar power when the sun isn’t shining is falling in a similarly stunning arc.”9

Even with the Trump administration vowing to repeal impending regulations including the Clean Power Plan or withdraw from the COP21 Paris Accords which he legally can’t do for 3-4 years,10 the increasing, global use of renewable and energy conserving technologies will further reduce the demand for carbon-based fuels. Litigation to prevent the Trump administration’s roll back of climate mitigation strategies will occur and could maintain certain Obama era regulations in place.11 Meanwhile, as demand for coal, oil and gas declines, a Carbon Bubble will inflate over the energy sector.12

A Carbon Bubble develops once the in-ground assets of fossil fuel companies are regarded as overvalued and overpriced, leading to a potential “rushing for the exits” to abandon aforementioned investments. 13 As much of a fossil fuel company’s financial valuation lies in the companies “booked reserves”, the inability of the companies to mine, process, sell and/or burn those “booked” carbon reserves place’s their long-term stock price in jeopardy.

In HSBC’s report, Stranded Assets: What’s Next, the white paper explains,

Stranded by energy innovation: Going forward, we think the risks of fossil fuel asset stranding could come from energy efficiency and advancements in renewables, battery storage and enhanced oil recovery. These drivers would impact demand for some fossil fuels, but while the timing of such structural events is difficult to predict, the challenge facing investors is to devise a strategy around the stranded assets theme that captures both climate commitment and fiduciary duty.14

In Citi’s report Energy Darwinism II, the economists at Citi GPS discuss the concept of stranded assets,

Many long-term broad-based investors believe that climate change is one of the biggest systemic risks they face, as well as presenting one of the largest opportunities. Tackling climate change is seen as being important to the long-term health of the economy and therefore to investment returns.15

The Citi report later comments about the issue of hedging investments against stranding risk: “Investors may hedge their portfolios against stranded asset risk by allocating funds to low emissions or clean technology investment options.”16

To completely ascertain the potential overall global fossil fuel assets vulnerable to stranding, Vladimir Stenek of the World Bank estimates the current value of the Carbon Bubble at approximately $20 trillion17 while Citi in the report Energy Darwinism II placed the estimate at upward of $100 Trillion.18

According to James Leaton at Carbon Tracker, the market value of the top 100 public oil and gas companies and the top 100 public coal companies listed in the report exceeds $7 trillion, approximately 12% of the global public equity market.19 In addition to public company reserves, state owned companies and reserves have a global market value of proved fossil fuel reserves equal to $27 trillion based on current market prices.20 With each of the above listed estimates, a consensus has formed regarding the extensive financial assets at risk from a carbon bubble deflation.

With the above stranding risk illustrated, Climate scientists and economists assert that 80% of coal, oil and gas reserves must remain in the ground to maintain global temperatures below 2C/3.6F and, by consequence, a more livable planet.21 Known as the Carbon Budget, climate scientists have calculated the amount of carbon tied to temperature rise allowable to be burned and, by current estimates, 1.5 C of temperature rise will be breached in 8 -10 years and 2C by 2036.22 With the overwhelming majority of fossil fuel reserves being unburnable, the market capitalization for both behemoth public firms and privately or state owned oil, coal, and gas operations will be wiped out as assets are stranded.

“In 2000, the dot-com bubble burst, destroying $6.2 trillion in household wealth over the next two years. Five years later, the housing market crashed, and from 2007 to 2009, the value of real estate owned by U.S. households fell by nearly the same amount — $6 trillion”.23 With the above examples in mind, making the connection between the fiscal hazard of stranded assets and the size and scope of the financial risks involved becomes clear and requires governmental action. Just as the infamous “subprime mortgages” suddenly lost value in 2008, investors will understand fossil fuel stocks and bonds will have “asset prices appear to be based on implausible” thinking about future values and the bubble will burst.24

Other risks haunt the fossil fuel industry as well. Consider legislative regulation and rapidly developing competition from alternative energy sources.25 Increases in the cost of production per barrel of oil, greater taxes on earnings or the removal of subsidies or a Republican proposal to enact a carbon fee and dividend program are a few key headwinds.26 Increasing cost competitiveness of sustainable energy technologies combined with the ability to secure stable long-term prices for power27, and an increase in distributed electricity models, could continue to shift capital allocation away from fossil fuels.28

As noted by Goldman Sachs (GS) in the report The Low Carbon Economy, increased regulations, such as mounting emissions-related compliance costs as well as reputational risks (brand damage) may cause financial losses across the fossil fuel energy spectrum.29 In the same report, GS sees little indication that global regulatory pressure is abating. And while the Trump administration has shown outright hostility to regulating greenhouse gas emissions by the EPA, the 194 signatories of the COP21 accords will move forward with China taking a lead role in developing the next generation of energy technology and thus leading the fight against climate change.30 According to a Barclays Plc energy analysts, the fossil fuel industry risks losing $33 trillion in revenue over the next 25 years as global warming may drive companies to leave the oil, natural gas, and coal sectors.31

Long term investors must recognize their fiduciary responsibility to future pension holders. Decisions made today will affect city budgets and pensioners now and into the future. Divestment from fossil fuel holdings must be strongly considered as a real risk/reward scenario.

As the risk of investing in fossil fuels increases, the opportunity to benefit from the developing low carbon economy becomes financially attractive, especially as the green economy is a multi-trillion-dollar growth opportunity32. The primary drivers in the market consist of battery storage, smart grid technology, hybrid & electric vehicles, solar and onshore wind power generation.33 The International Energy Agency forecasts global energy growth to increase 50% by 2040 and the growing demand must be met by alternative energy sources and technologies as listed above to maintain temperatures below 2C of global temperature rise.34

Meanwhile, a de-carbonization of the energy sector is already taking place. Collectively LEDs, onshore wind, solar PV, and hybrid & electric vehicles present a set of breakthrough technologies. Rapidly taking market share in global lighting (69% by 2020 vs. 28% today), new power generation (51% by 2025 vs. 20% today), and autos (22% in 2025 vs. 3% today), the next generation of energy technology promises to create millions of jobs and expand wealth opportunities while reducing the worlds carbon emissions according to The Low Carbon Economy. The adoption of the above renewable technologies has been steadily trending upward on a global scale and presents attractive opportunities for new investors.35

Big Oil’s Forthcoming Decline and Crash

With oil producers such as Exxon (3.3Billion Barrels), Conoco Philips (1.15 Billion Barrels) and Shell (~1 Billion Barrels) de-booking proven oil sands reserves from their balance sheets due to the low price of oil on commodity markets termed by Bloomberg as the worst oil slump in a generation, future de-listing of reserves from balance sheets will become more prevalent.36,37 The costliest oil reserves to produce will be removed first followed by oil fields with the next level of difficult economic costs as demand for liquid fuels diminishes due to regulations and the growth of EV’s. And with EV’s poised to rapidly gain popularity with consumers, more oil will be removed from balance sheets over the next several years.

The Grantham Institute of Imperial College London estimates in the report The Disruptive Power of Low-Carbon Technology peak oil demand will occur approximately in the year 2020,

By 2050, EV’s account for over two-thirds of the road transport market. This growth trajectory sees EV’s displacing approximately 2 million barrels of oil per day(mbd) in 2025 and 25mbd in 2050. To put these figures in context, the recent 2014-2015 oil price collapse was the result of a 2 mbd (2%) shift in the supply-demand balance.38

James Arbib and Tony Seba of Stanford University predict a sharper and more drastic disruption of oil markets, Based on S-Curve economic models, the authors predict rapid adoption of EV’s and Automated EV’s once federal regulatory approval occurs in approximately 2020-21. Seba and Arbib assert 95% of passenger ride miles in the transportation sector will be dominated by Automated EV’s by 2030 and consumers of said miles will no longer own automobiles, but will merely adopt the Transportation as a Service (TaaS) model and hail each ride, thus saving approximately $5600/year, per family.39

In February of 2016, Bloomberg New Energy Finance reported on the global advance of Electric Vehicles (EV’s): “We calculated the effect of continued 60 percent growth (of EV’s). We found that electric vehicles could displace oil demand of 2 million barrels a day as early as 2023. That would create a glut of oil equivalent to what triggered the 2014 oil crisis.”40 Goldman Sachs in The Low Power Economy stated, “we expect sales in grid connected vehicles (EV’s) to increase 7.7x by 2020 to 2.5 mn vehicles per year.”41 The BNEF article on Electric Vehicles concludes with the following paragraph: “One thing is certain: Whenever the oil crash comes, it will be only the beginning. Every year that follows will bring more electric cars to the road, and less demand for oil. Someone will be left holding the barrel.”42

While a difference exists between both analysis of Grantham and Bloomberg, the forthcoming crash of oil prices due to slackening demand will cause irrevocable disruptions in the oil industry due to high extraction costs and drive further consumption away from gasoline powered transportation and toward vehicles fueled by electricity.

Coal’s Quickly Diminishing Future

Coal has already experienced the disruptive force of the installation and producing power of renewable energy and cheap natural gas for power generation. According to the Goldman Sachs report The Low Carbon Economy, the four largest coal companies lost over 90 percent of their market capitalization in 2015 alone.43 As coal for power generation is the single largest emitter of greenhouse gases, regulations and the price of natural gas, on-shore wind and Solar PV have reduced coals financial viability, leading to a dramatic shift.

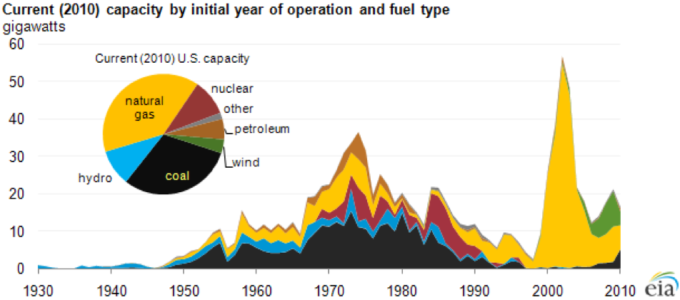

Folded into the equation of coals reduced viability is the aging infrastructure of coal power plants. According to the Energy Information Agency, most coal fired power plants are between 30 – 60 years old.44 With coal no longer competitive compared to the price of renewables, coal will soon be displaced as the major producer of electricity.

In fact, Citi analyst Ed Morse states, “No board of directors of a utility is gonna sanction a new thermal coal power plant that’s gonna last fifty years.” 45

Solar Power

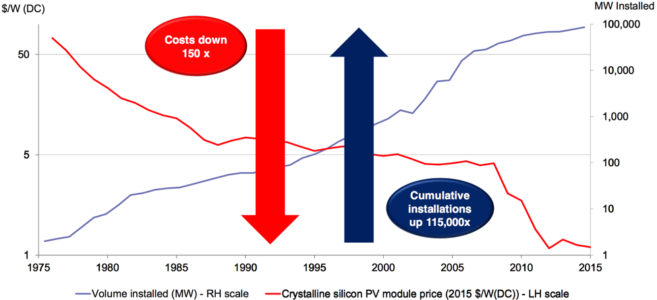

As for the prospects for Solar in 2017, Bloomberg New Energy Finance showed, “Solar system costs are expected to fall at least a further 10 percent in 2017. Modules will fall another 25 percent or so, so that the cheapest type of standard solar module, multi-crystalline silicon, will be around 32 U.S. cents per watt by year-end. Good news for the competitiveness of solar.”46

In the chart below, BNEF depicts the rapid decline in equipment costs for solar technology occurring during the 1975 -2015 period with a staggering decline happening between 2008 and 2015.47

Since the passage of the Illinois Future Energy Jobs Bill, growth in the solar industry in the state is projected to add an additional 2,700 MW of Solar generation capacity in the state by 2030.48

The Energy Information Agency (EIA) of the federal government states,

Utility-scale solar installations—including both photovoltaic (PV) and thermal technologies—grew at an average rate of 72% per year between 2010 and 2016, faster than any other generating technologies. Utility-scale solar (plants with a capacity of at least one megawatt) now makes up about 2% of all utility-scale electric generating capacity and 0.9% of utility-scale generation. As of December 2016, more than 21.5 gigawatts (GW) of utility-scale solar generating capacity was in operation across the United States, with more than 7.6 GW of that capacity coming online in 2016.49

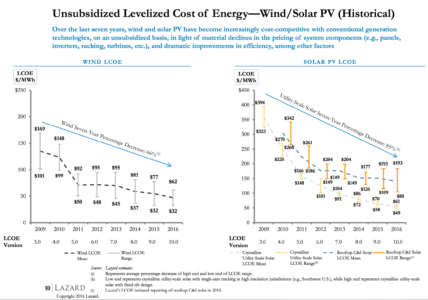

Lazard Ltd. a financial advisory firm has shown the costs for Solar PV have dropped by 85% since 2009 while on-shore wind power costs have fallen by 66% since 2009.50

Wind Power

According to BNEF, the forecast for wind power investments, “expects another 59 gigawatts to be commissioned in 2017 worldwide, slightly up on last year’s 57 gigawatts but still short of the 63-gigawatt record in 2015.”51 The EIA has determined for the United States, “Wind energy capacity at the end of 2016 was 81 gigawatts (GW). EIA expects capacity additions in the forecast will bring total wind capacity to 95 GW by the end of 2018.”52

As investment house Lazard recently reported, the cost of wind generation has dropped 66% from 2009 – 20162 while the cost of solar has fallen by 85% over the same time period.53

Projections for wind power installations in the United States are slated to increase to 20% of all domestic production by 2030 and 35% by 2050 according to the Department of Energy’s Wind Vision report of 201554 With states such as New York, Illinois, Oregon, California and the District of Columbia increasing their Renewable Portfolio Standards(RPS) in the past calendar year, a total of 29 states have mandated a percentage of overall electricity capacity generated from both wind and solar.55 The percentages of power generation from renewable energy sources will only accelerate as many states and municipalities have pledged to meet the COP21 Paris accord standards regardless of political and policy actions taken by the Trump Administration.56 With environmental activists seeking to gain political traction for the OFF Act authored by Hawaii Congressional Representative Tulsi Gabbard, the shift in portfolio standards for the entire United States will probably continue to trend upward rather than the opposite and fossil fuel losses could reach 33 Trillion dollars.57

Battery Storage Technology Facilitates Renewables Growth

With a key technology to unleashing further gains in renewables being battery storage, BNEF depicts the cost of storage capacity to continue declining, stating,

We predict a doubling of new capacity from this year’s 700 megawatts to 1.5 gigawatts, almost all of it lithium-ion batteries. With Tesla’s Gigafactory and several other large manufacturing facilities coming on stream in 2017, we are going to see a further reduction in battery prices of at least 15 percent this year, after a 70 percent reduction in the past five years.58

BNEF also noted in an article entitled, Batteries Gaining Favor Over Gas Peaker Plants in California,

“Batteries can also meet peak demands with lower emissions than natural gas-fired peakers by charging during low-demand periods when excess wind and solar energy is being generated, and discharging during peak demand periods, which displaces the need to burn incremental natural gas in a peaker.”

Southern California Edison has contracts for more than 275 megawatts of storage capacity from suppliers that include AES Corp. and Advanced Microgrid Solutions LLC. It plans to solicit as much as 120 megawatts of additional capacity in 2016.

Regulators have asked California’s three biggest utilities to line up 1.3 gigawatts of storage capacity by 2020, and set a target of 580 megawatts for Southern California Edison. That may come from batteries or other technologies.59

With regard to investment gains in Battery Storage technology, Morgan Stanley outlines the potential growth in their March 6th 2017 report titled Renewable Energy Storage: The Next Power Play,

“Demand for energy storage from the utility sector will grow more than the market anticipates by 2019-20,” the report posits. The demand for storage is expected to grow from a less than $300 million a year market to as much as $4 billion in the next two to three years, says the Morgan Stanley report. Ultimately there’s about a $30 billion market for storage units, with capacity for around 85 gigawatt-hours of power storage. That’s enough electricity to light up most of the New York City metro area for a year.

The Morgan Stanley report further illustrates the capacity of storage technology to enhance the reliability of solar and wind generation by stating, “New renewable energy storage technology has the power to turn solar and wind energy into a reliable source of electricity generation for U.S. utilities.”60

The Future of Energy Investment

In BNEF’s New Energy Outlook 2017 report, the economists open the document with the following forecast. “Cheaper coal and cheaper gas will not derail the transformation and de-carbonization of the world’s power systems. By 2040, zero-emission energy sources will make up 60% of installed capacity. Wind and solar will account for 64% of the 8.6TW of new power generating capacity added worldwide over the next 25 years, and for almost 60% of the $11.4 trillion invested.”61

Even with the desire of the Trump administration to prop up the various sectors of the fossil fuel industry, the momentum for clean energy technology will continue to accelerate, especially as costs of renewables drop precipitously. Onshore wind and Solar PV will, “become the cheapest ways of producing electricity in many countries during the 2020s and in most of the world in the 2030s. Onshore wind costs fall by 41% and solar PV costs fall by 60% by 2040.”62

Meanwhile, the rest of the world will continue to invest in clean energy technology with China poised to become the greatest financial investor and standing to gain global leadership in the renewable energy sector, creating over 13 million new jobs between 2015 and 2020. According to Goldman Sachs The Low Power Economy, “China just increased its 2020 solar target by 50% to 150 GW, India raised its 2022 target 5x to 100 GW).”63 In the concluding section of the Low Power Economy, GS foresees, “low carbon technologies beginning to replace carbon-intensive incumbent technologies at an accelerating rate.”64

Consider the implications of divesting from fossil fuels and re-investing, either directly or through financial products, into renewable energy technology in the local economy. The green economy could see development and widespread growth, offering job and wealth creation opportunities for local stakeholders and shareholders alike. The solar industry alone employs 374,000 nationwide an increase of 25 percent in 2015-2016 alone.65 In 2015, renewable energy jobs increased 6%, oil and gas jobs decreased by 18%.66

Alternative energy jobs in Illinois represent more jobs than the accounting & real estate industries combined.67 The Chicagoland Green Collar Jobs Initiative is a private operation working to develop Chicago’s green-collar work force–positions that would ideally be filled by the City’s low-income and at-risk populations.68 With predicted slackening demand placing the fossil fuel industry in financial peril, the opportunities involved in rotating funds into the thriving alternative energy sector leave fiduciaries of investable assets with a clear-cut decision: divestment from fossil fuel assets should be an active part of today’s investment strategy.

Divestment Opportunity

As for the costs of divestment to pension funds and the operating budget, several studies have concluded pension and endowments proceeding through the action of divesting from fossil fuel stocks and bonds will either have portfolios matching previous performance or achieving slightly better returns on investments. MSCI, IMPAX Mgmt. and the Aperio Group have produced studies depicting the positive outcomes from divesting.

MSCI concluded the following in in the report Responding to the Call for Fossil-Free Portfolios:

Risk: Fossil fuel divestment has the potential to reduce overall portfolio risk because of Energy Sector volatility.

-

Performance: 1, 3 and 5-year results were consistent between the two MSCI time series analyses, showing modest risk-adjusted outperformance from divestment over those time periods. Ten-year results showed modest risk-adjusted underperformance from divestment, primarily as a result of high oil prices in the early years of the time series.

-

Investors considering fossil fuel divestment should answer the following questions:

-

Since divesting of fossil fuels has the potential to reduce overall portfolio risk (because Energy is a relatively risky sector), what is the most effective way for them to allocate risk?

-

How will they compensate for the impact of underweighting Energy Sector investments?69

-

In the Aperio Group’s report, Building a Carbon-Free Equity Portfolio, the financial analysts concluded, “From the (divestment) skeptics, investors may hear that screening will adversely affect risk and return and that the goal of any endowment should be to focus exclusively on financial goals. The data do not support the skeptics’ view that screening negatively affects an index-tracking portfolio’s return. In fact, they show that the impact on risk may be far less.”70

Impax Management described potential positive returns thus:

Analysis of historical data shows that over the past seven years eliminating the fossil fuel sector from a global benchmark index would have actually had a small positive return effect. Furthermore, much of the economic effect of excluding fossil fuel stocks could have been replicated with ‘fossil free’ energy portfolios consisting of energy efficiency and renewable energy stocks, with limited additional tracking error and improved returns.71

Beyond the three studies cited above, a number of investment houses, investment analysts, the financial press, and academics have declared various fossil fuel assets as too risky to maintain and warn of the financial losses possible when fossil fuel companies become stranded. On May 5th, 2017, AXA Investment Managers announced it,

has pledged to divest 165 million euros (175 million dollars) of its fixed-income portfolios and 12 million euros (13 million euros) of equities portfolios as a result of its new coal policy. It announced that it won’t invest in companies that derive more than 50 per cent of their revenue from coal-related activities (specifically mining and electric utilities companies) starting from the 30th of June. The coal policy will apply to 714 billion euros (782 billion dollars), equal to 99.5 per cent of assets under management at AXA IM.72

As HSBC Global Research asserted in the white paper, Stranded Assets: What’s Next,

Going forward, we think the risks of fossil fuel asset stranding could come from energy efficiency and advancements in renewables, battery storage and enhanced oil recovery. These drivers would impact demand for some fossil fuels, but while the timing of such structural events is difficult to predict, the challenge facing investors is to devise a strategy around the stranded assets theme that captures both climate commitment and fiduciary duty.73

As the Organization for Economic Cooperation and Development (OECD) noted in their paper Divestment and Stranded Assets in the Low-carbon Transition,

The intertwined issues of divestment and stranded assets are likely to grow in importance in the coming years, if the past few years are any indication. Much can be done to increase the visibility of these issues for interested stakeholders, including the financial sector. The significant economic and technological transformations required to stay on track with a 2°C objective will not leave fossil fuel companies and energy-intensive activities unscathed, as only a fraction of all available fossil fuel reserves and resources can be burned. This will impact assets value, and the sooner the financial sector stakeholders understand the situation, the less disruptive the transition will be.74

In December of 2016, The Economist reported on the issue of stranded assets and potential losses to the oil industry due to a de-carbonization of the energy sector: “Mark Lewis, of Barclays, says that if measures to stop global warming are fully implemented, oil-company revenues could fall by more than $22trn over the next 25 years, more than twice the predicted decline for the gas and coal industries combined.”75

In a study led by Simon Dietz of the London School of Economics, the authors found,

If action is taken to tackle climate change, the study found the financial losses would be reduced overall, but that other assets such as fossil fuel companies would lose value. Scientists have shown that most of the coal, oil and gas reserves such companies own will have stay in the ground if the global rise in temperature is to be kept under 2C. The total stock market capitalization of fossil fuel companies today is about $5tn.

Investors have also been warned about investing in new coal and gas fired power stations after 2017 by a second new study. The research shows that, to meet the 2C target, no new carbon-emitting power stations can be built anywhere in the world unless they are later closed down or retrofitted with carbon capture and storage technology.

Professor Dietz was quoted from the same study regarding stranded assets and the perils to pension funds of not taking steps to address financial risk from maintaining investments in fossil fuel companies,

“Our work suggests to long-term investors that we would be better off in a low-carbon world,” said Prof Simon Dietz of the London School of Economics, the lead author of the study. “Pension funds should be getting on top of this issue, and many of them are.” He said, however, that awareness in the financial sector was low.7

Conclusion

As the quotations from all the various sources cited in the paper above assert, divesting from risky fossil fuel assets provides a fiscally conservative means of reducing overall financial risk to pension funds and city operating budgets. With the accelerated adoption of renewable energy sources, battery storage technology and efforts to increase energy efficiency well underway in the global marketplace, each of the evidential references contained in this document are a mere fraction of the available literature outlining the coming green technology revolution and the potential risks to investment portfolios exposed to vulnerable investments in fossil fuel assets.

While we can’t be predictive about when a carbon bubble may burst and fossil fuel investments lose valuation, we can see the trend lines forming. And the current shift occurring across the industrialized world is to move away from dirty fuels and toward cleaner, greener energy sources for power generation and transportation systems. With the above in mind, the city and the pension fund managers should immediately begin thinking through the process of divesting from those fossil fuel assets in order to protect taxpayers and pensioners against the risk of a carbon bubble bursting due to stranded assets. The pension fund managers should also develop a plan to perform the work of divesting over a 5-year period. Chicago350 asks the City Treasurer and the pension fund managers to immediately cease investment activity in the top 200 fossil fuel companies and formulate a plan over the course of a year to meet the 5-year timeline to divest from the same.

Executive Summary References

- Photo by © Hans Hillewaert, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=6361901

- http://www.independent.co.uk/environment/solar-and-wind-power-cheaper-than-fossil-fuels-for-the-first-time-a7509251.html#gallery

- http://www.businessinsider.com/solar-power-energy-renewables-cheapest-power-says-morgan-stanley-2017-7; https://www.morganstanley.com/ideas/solar-wind-renewable-energy-utilities

- https://static1.squarespace.com/static/585c3439be65942f022bbf9b/t/591a2e4be6f2e1c13df930c5/1494888038959/RethinkX+Report_051517.pdf

- http://www.goldmansachs.com/our-thinking/pages/new-energy-landscape-folder/report-the-low-carbon-economy/report.pdf 48

- https://www.cnbc.com/2017/04/05/reuters-america-column-trump-cannot-turn-back-time-for-aging-coal-fired-power-plants-kemp.html

- https://www.bloomberg.com/features/2016-ev-oil-crisis/

- http://www.imperial.ac.uk/media/imperial-college/grantham-institute/public/publications/collaborative-publications/Expect-the-Unexpected_CTI_Imperial.pdf Executive Summary

- https://static1.squarespace.com/static/585c3439be65942f022bbf9b/t/591a2e4be6f2e1c13df930c5/1494888038959/RethinkX+Report_051517.pdf

- https://www.morganstanley.com/ideas/solar-wind-renewable-energy-utilities

- https://www.morganstanley.com/ideas/renewable-energy-storage-solar-electric-grid

Report References

- https://www.nasa.gov/press-release/nasa-noaa-data-show-2016-warmest-year-on-record-globally

- https://scripps.ucsd.edu/programs/keelingcurve/2015/05/12/what-does-this-number-mean/

- https://www.scientificamerican.com/article/earth-will-cross-the-climate-danger-threshold-by-2036/

- https://public.wmo.int/en/media/press-release/provisional-wmo-statement-status-of-global-climate-2016

- https://app.box.com/s/t050csk2z20iqk9u14vnllz3i15dh5i0

- https://www.theguardian.com/environment/planet-oz/2017/may/09/planet-could-breach-15c-warming-limit-within-10-years-but-be-aware-of-caveats

- http://www.independent.co.uk/environment/solar-and-wind-power-cheaper-than-fossil-fuels-for-the-first-time-a7509251.html

- http://www.goldmansachs.com/our-thinking/pages/new-energy-landscape-folder/report-the-low-carbon-economy/report.pdf 14

- http://www.smh.com.au/business/energy/wind-and-solar-are-crushing-fossil-fuels-20160407-go0ura.html

- http://www.newsweek.com/donald-trumps-climate-change-hit-list-519904

- https://www.usnews.com/news/best-states/illinois/articles/2017-03-29/environmental-groups-vowing-to-fight-trump-climate-actions

- http://www.carbontracker.org/report/stranded-assets-danger-zone/

- https://ir.citi.com/E8%2B83ZXr1vd%2Fqyim0DizLrUxw2FvuAQ2jOlmkGzr4ffw4YJCK8s0q2W58AkV%2FypGoKD74zHfji8%3D 95

- https://www.businessgreen.com/digital_assets/8779/hsbc_Stranded_assets_what_next.pdf

- https://ir.citi.com/E8%2B83ZXr1vd%2Fqyim0DizLrUxw2FvuAQ2jOlmkGzr4ffw4YJCK8s0q2W58AkV%2FypGoKD74zHfji8%3D 95

- https://ir.citi.com/E8%2B83ZXr1vd%2Fqyim0DizLrUxw2FvuAQ2jOlmkGzr4ffw4YJCK8s0q2W58AkV%2FypGoKD74zHfji8%3D 96

- http://blogs.worldbank.org/climatechange/carbon-bubbles-stranded-assets

- https://ir.citi.com/E8%2B83ZXr1vd%2Fqyim0DizLrUxw2FvuAQ2jOlmkGzr4ffw4YJCK8s0q2W58AkV%2FypGoKD74zHfji8%3D 118

- https://www.allianz.com/en/about_us/open-knowledge/topics/finance/articles/150811-Whats-the-best-way-to-avoid-a-carbon-crash/

- https://www.carbontracker.org/wp-content/uploads/2014/09/Unburnable-Carbon-Full-rev2-1.pdf Executive summary pg. 2

- https://www.theguardian.com/environment/planet-oz/2017/may/09/planet-could-breach-15c-warming-limit-within-10-years-but-be-aware-of-caveats

- https://fivethirtyeight.com/features/why-the-housing-bubble-tanked-the-economy-and-the-tech-bubble-didnt/

- http://blogs.worldbank.org/climatechange/carbon-bubbles-stranded-assets

- https://www.weforum.org/press/2016/12/a-convenient-truth-fighting-climate-change-turned-into-a-profitable-business/

- https://www.washingtonpost.com/news/energy-environment/wp/2017/02/07/senior-republican-leaders-propose-replacing-obamas-climate-plans-with-a-carbon-tax/?utm_term=.26a7c4743038

- https://www.washingtonpost.com/news/energy-environment/wp/2017/02/07/senior-republican-leaders-propose-replacing-obamas-climate-plans-with-a-carbon-tax/?utm_term=.55461fd2f5e5

- http://cacurrent.com/subscriber/archives/9320

- http://www.goldmansachs.com/our-thinking/pages/new-energy-landscape-folder/report-the-low-carbon-economy/report.pdf 6

- https://www.bloomberg.com/news/articles/2017-02-22/exxon-takes-historic-cut-to-oil-reserves-amid-crude-market-rout

- https://www.nytimes.com/2017/03/29/world/asia/trump-climate-change-paris-china.html?mcubz=3

- https://www.bloomberg.com/news/articles/2016-07-11/fossil-fuel-industry-risks-losing-33-trillion-to-climate-change

- http://www.wri.org/blog/2015/07/multi-trillion-dollar-opportunity-better-growth

- https://www.bloomberg.com/features/2016-ev-oil-crisis/

- https://www.iea.org/publications/freepublications/publication/WEO2015SpecialReportonEnergyandClimateChange.pdf

- http://www.goldmansachs.com/our-thinking/pages/new-energy-landscape-folder/report-the-low-carbon-economy/report.pdf 48

- http://oilprice.com/Energy/Energy-General/Have-The-Majors-Given-Up-On-Canadas-Oil-Sands.html

- https://www.bloomberg.com/news/articles/2017-03-09/shell-becomes-gas-company-with-7-25-billion-oil-sands-sale

- http://www.imperial.ac.uk/media/imperial-college/grantham-institute/public/publications/collaborative-publications/Expect-the-Unexpected_CTI_Imperial.pdf Executive Summary

- https://static1.squarespace.com/static/585c3439be65942f022bbf9b/t/591a2e4be6f2e1c13df930c5/1494888038959/RethinkX+Report_051517.pdf

- https://www.bloomberg.com/features/2016-ev-oil-crisis/

- http://www.goldmansachs.com/our-thinking/pages/new-energy-landscape-folder/report-the-low-carbon-economy/report.pdf 49

- https://www.bloomberg.com/features/2016-ev-oil-crisis/

- http://www.goldmansachs.com/our-thinking/pages/new-energy-landscape-folder/report-the-low-carbon-economy/report.pdf 7

- https://www.eia.gov/todayinenergy/detail.php?id=1830

- https://www.bloomberg.com/news/articles/2017-02-22/exxon-takes-historic-cut-to-oil-reserves-amid-crude-market-rout See Embedded Video

- https://about.bnef.com/blog/10-renewable-energy-predictions-2017/

- http://www.smh.com.au/business/energy/wind-and-solar-are-crushing-fossil-fuels-20160407-go0ura.html

- http://midwestenergynews.com/2017/08/02/solar-for-all-can-illinois-energy-bill-live-up-to-ambitious-promises/

- https://www.eia.gov/todayinenergy/detail.php?id=31072

- https://www.lazard.com/media/2390/lazards-levelized-cost-of-energy-analysis-90.pdf

- https://about.bnef.com/blog/10-renewable-energy-predictions-2017/

- https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf

- https://www.lazard.com/media/438038/levelized-cost-of-energy-v100.pdf 10

- https://www.energy.gov/eere/wind/maps/wind-vision

- http://www.ncsl.org/research/energy/renewable-portfolio-standards.aspx

- https://www.nytimes.com/2017/03/29/world/asia/trump-climate-change-paris-china.html

- https://www.bloomberg.com/news/articles/2016-07-11/fossil-fuel-industry-risks-losing-33-trillion-to-climate-change

- https://about.bnef.com/blog/10-renewable-energy-predictions-2017/

- http://www.renewableenergyworld.com/articles/2015/12/batteries-gaining-favor-over-gas-peaker-plants-in-california.html

- https://www.morganstanley.com/ideas/renewable-energy-storage-solar-electric-grid

- https://www.bloomberg.com/company/new-energy-outlook/

- https://www.bloomberg.com/company/new-energy-outlook/

- http://www.goldmansachs.com/our-thinking/pages/new-energy-landscape-folder/report-the-low-carbon-economy/report.pdf

- http://www.goldmansachs.com/our-thinking/pages/new-energy-landscape-folder/report-the-low-carbon-economy/report.pdf

- http://www.independent.co.uk/news/world/americas/us-solar-power-employs-more-people-more-oil-coal-gas-combined-donald-trump-green-energy-fossil-fuels-a7541971.html

- http://www.irena.org/News/Description.aspx?NType=A&mnu=cat&PriMenuID=16&CatID=84&News_ID=1450

- http://news.medill.northwestern.edu/chicago/illinois-energy-policy-challenged/

- http://cgcji-dev.cjc.net

- https://www.msci.com/documents/10199/57518ec8-5588-4453-a55f-fa9e294d8ee2

- https://www.aperiogroup.com/resource/138/node/download

- https://www.impaxam.com/media-centre/white-papers/beyond-fossil-fuels-investment-case-fossil-fuel-divestment

- https://institutional.axa-im.co.uk/home/-/news/axa-investment-managers-divests-from-companies-most-exposed-to-coal/10341/maximized/uY8M

- https://www.businessgreen.com/digital_assets/8779/hsbc_Stranded_assets_what_next.pdf

- https://www.oecd.org/sd-roundtable/papersandpublications/Divestment%20and%20Stranded%20Assets%20in%20the%20Low-carbon%20Economy%2032nd%20OECD%20RTSD.pdf 22

- https://www.economist.com/news/special-report/21710632-oil-companies-need-heed-investors-concerns-how-deal-worries-about-stranded

- https://www.theguardian.com/environment/2016/apr/04/climate-change-will-blow-a-25tn-hole-in-global-financial-assets-study-warns

##############################################################